Research Reports and Data Of Interest

The European kiosk market is undergoing rapid transformation driven by advances in interactive technology, digital payments, and changing consumer behavior. Across retail, transportation, healthcare, and hospitality, kiosks are now integral to enhancing customer experience, improving operational efficiency, and supporting data-driven business models. The widespread adoption of self-service terminals aligns with Europe’s growing focus on automation, user convenience, and contactless interaction—trends accelerated by the pandemic and sustained by long-term digitalization efforts.

Worth noting the ratio of unattended to attended is much higher in Europe. In the US, a KFC may have two kiosks. In Europe it can easily be ten.

Market research tries to examines the current state of kiosk deployment across major European economies, including Germany, the United Kingdom, France, and the Nordic region. It explores key growth drivers such as artificial intelligence integration, improved touchscreen interfaces, and cloud-based management systems. We want to assesses competitive dynamics, emerging use cases, and evolving regulatory frameworks that shape market expansion.

As Europe moves toward a more connected and automated environment, kiosks represent a strategic intersection of hardware innovation, customer engagement, and service delivery. We hope to provide insight into market size, growth projections, and opportunities for stakeholders seeking to leverage kiosk technologies to enhance user experience and operational agility in an increasingly digital economy.

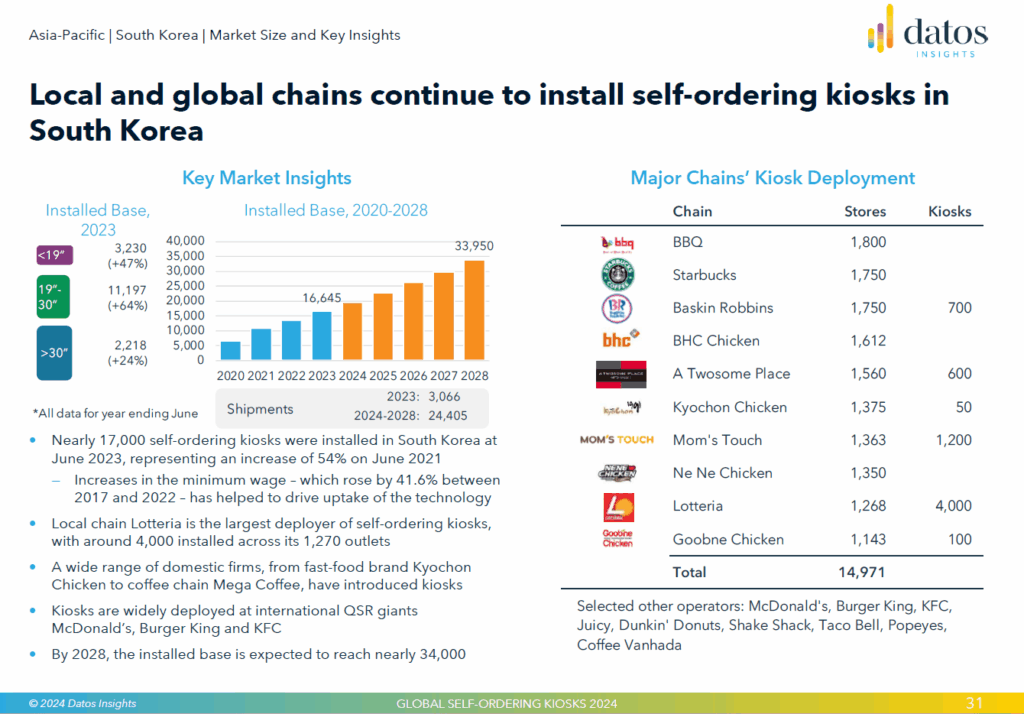

Having said that, let’s take a look at South Korea. It is close parallel.

kiosk market research korea

Global Research Reports, Data, Regulatory Standards and More

Takeaway on global kiosk market — A more conservative, “real” estimate from direct industry participants—especially in the U.S.—often puts the true kiosk sector (excluding ATM, vending, and all tangential categories) at closer to $8–15 billion globally for core interactive and self-service kiosks.

Below is how we define the core kiosk sector and why third-party numbers often overstate its size.

-

Core kiosk = staffed? unstaffed? touch/voice? fixed vs. portable?

-

What’s excluded : ATM, ITMs, lottery, full-service POS lanes/SCO (if you wish), vending, EV chargers, ticket printers without UI, etc.

-

Why syndicated numbers skew high: broad scope, desk research bias, resold datasets.

Kiosk Market Reports Data

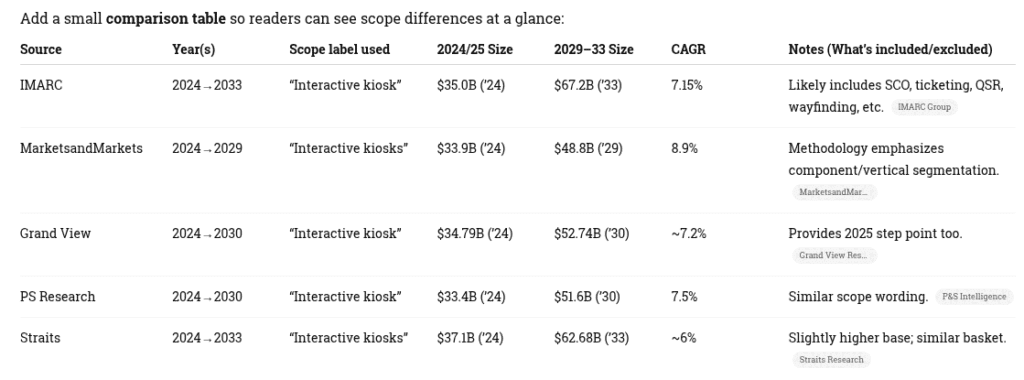

- 2025 – Research and Markets estimated the U.S. self-service kiosk market at $2.4 billion, projecting growth to $4.6 billion by 2026 at a 13.6% CAGR. For 2024 – IMARC projected the global interactive kiosk market at $35 billion, with growth to $67.2 billion by 2033, representing a 7.5% CAGR.

- 2025 – IndustryArc — Self-Service Kiosk Market size is estimated to reach US$43.6 billion by 2030, growing at a CAGR of 6.4% during the forecast period 2024-2030. Odd how they list Ingenico, PopID, Toshiba and Armodilo as major kiosk manufacturers? Examples of internet scrapes. Most firms that publish these estimates make money selling research reports and often lack direct interviews, field audits, or validation with actual large kiosk deployers and manufacturers.

- There is some value in the datamarts — they pounce on the highest frequency mention technology and generate dummy report to sell. That is a barometer of sorts. The more attention they deem profitable to pitch too, the more activity in that industry. Admittedly, an ironic benefit.

- 2021 – The kiosk industry commissioned BCC to create a comprehensive kiosk report in 2021. 134 pages and interviews with actual participants provided the data and basis. Here is copy of our last report — 2019 Report KMA – Self Service Kiosks (contact [email protected]) — for specific competitive intelligence, accurate company rankings, industry nuances, or tactical investment decisions, our reports include by design key real-world detail or context. Here is our content which formed much of the basis. Charts and numbers projected are never as good as genuine insight.

- Contrast with TIG’s $8–15B “core kiosks” (our takeaway). Consider our exclusion list explicitly (no ATM, no vending, no tangential devices). That makes our conservative framing more rigorous.

- We can compare —

Restaurant Reports

- 2025 National Restaurant Association “State of Industry”. Operators remain cautiously optimistic. Top challenges include rising labor (96%) and food costs (95%), with inflation and energy costs remaining secondary but significant burdens. State of the Restaurant Industry 2025-compressed

- Our own TIG analysis and summary.

- 2025 – Market report for Top 50 Point of Sale in restaurants. Included are SST (self-service tech tags) and you can sort/etc as you like. How to read — SST tags can be AI, robotics, lockers, vending and more.

- 2025 – Market Report Data for The Top 50 restaurants circa 10/25/2025 — you can sort by locations, CAGR, revenue, and of course unique to TIG by Self-Service technology tags or Notes if you like. I’ve included “speculative” as well.

- 2023 – NRN — Our look at Restaurant Technology TechStack Report – 400 restaurants surveyed by NRN in one of the better reports available (for free). 31 pages.

- We post to QSRMagazine

- We post to AVIXA (105 posts)

Payment

- TSG – ETA : retail spending study 2025 — TSG and the Electronic Transactions Association (ETA) conducted a survey consisting of 1,027 U.S. consumers to understand how payment method preferences shift across geography, how spending habits are poised to change year-over-year, and consumer sentiment on economic factors that may impact overall holiday spending trends. The survey was conducted between September 16, 2025 and September 24, 2025. The survey represents consumers across several demographics such as state, gender, age, geographical region and household income, with a margin of error of +/-3% at a 95% confidence level.

Regulatory

- 2025 – ATM – New Federal ATM legislation for Independent ATM Operators – Bruce Renard introduces Congressman Scott Fitzgerald at NAC 2025. NAC 2025: Legislative update U.S. Rep. Scott Fitzgerald, a Wisconsin Republican, offered an …

- 2024 – Bitcoin – Mandatory reporting of digital transaction kiosks in California PSA. Definition is a kiosk which is capable of accepting or dispensing cash in exchange for a digital financial asset. Effective January 1, 2024 — For more information on the law and information on how to submit the kiosk location list, please visit our website: https://dfpi.ca.gov/dfal-kiosk/.

- ADA — Code of Practice for kiosk manufacturers and deployers 2021 Revision

- U.S. Access Board ANPRM (SSTMs/kiosks) — Supplementary provisions for kiosks were noticed and remain pending; link the Federal Register docket. Federal Register

- HHS rule (2024) — “New Requirements on the Accessibility of Web Content, Mobile Apps, and Kiosks” for HHS-funded entities; helpful for healthcare readers. HHS.gov

- ADA Standards landing page — evergreen reference. Access Board

- 2019 – ADA Kiosk Association for US Access Board Guidelines

- Overview ADA and Accessibility z-Part 1-Master Overview 10202019-converted

- Mandated Requirements (How To Get Sued) z-Part 2-Mandated 10202019-converted

- PROPOSED Code Of Practice z-Part 3 -COP-10202019-converted

- TACTILITY, VOICE RECOGNITION AND SPEECH COMMAND z-Part 4-TactileVoiceSpeech-cop-converted

- Addendums z-Part 5-Addendum-converted

Surveys

- 2025 Kiosk Survey Data – facts and fantasy. Personal research + compendium of 2025 survey data that is often relevant but usually self-serving. Bit of ironic pun on self-service there…

- 2025 — Restaurant Accessibility Blind and Low Vision Customers — survey data by TPGi on making restaurants accessible

Archive Reports

- Updated 1995 Los Alamos kiosk report. Kudos to seminal mentions of Datacap, Kiosk Information Systems, and Elotouch

- Frost and Sullivan 2018 Kiosk Market Report — Customer Engagement and High Customer Satisfaction are the Key

Factors that will Lead to Growing Adoption of Self-service Kiosks Global Measurement & Instrumentation Research Team at Frost & Sullivan - QSR_2024_QSR50_REPORT-compressed — ABOUT THE QSR 50/ The QSR 50 is an annual ranking of limited-service restaurant companies by U.S. system-wide sales. QSR magazine directly from restaurant companies from March to May 2024.

Data Sources

- https://www.marketsandmarkets.com/Market-Reports/interactive-kiosks-market-221409707.html

- https://www.marketsandmarkets.com/Market-Reports/interactive-kiosks-market-221409707.html

- https://www.grandviewresearch.com/industry-analysis/interactive-kiosk-market

- https://www.psmarketresearch.com/market-analysis/interactive-kiosk-market

- https://straitsresearch.com/report/interactive-kiosks-market